There are several quick loans available in Nigeria using your smartphone. The application process has been made easy. Within minutes you can receive collateral-free loans with low interest rates and great terms.

As easy as acquiring a loan in Nigeria is, it is crucial you use loan apps with the best interest rates and terms. Although, it might be difficult to find the very low interest rates loans using loan apps in Nigeria, there are some you should note.

Here are top 20 loan apps with low interest rates and best terms in Nigeria, Fairmoney, palmcredit, carbon, Alat, Renmoney, Aella App, Palmpay, Umba loan, Okash, Migo, Specta Loan, Kuda, Easemoni, Jumiapay, P2vest, Page financial, Blocka Cash, Kredi, Yescredit, QuickCheck. Once you apply for a loan from any of these companies, you receive the loan instantly (3-5mins). These loan apps does not require a lot of documentation or any collateral. It’s easy, just sign up, apply and receive the credit.

Top 20 Loan Apps in Nigeria with Best Interest Rates and Terms

1. Fairmoney

Using the Fairmoney loan app, you can receive your loan credit within 3-5 minutes. You can also receive personal loans of up to N3 Million Naira from Fairmoney. It has a great repayment period of up to 2 months or even 2 years with low interest rates.

To apply for a loan with fairmoney you need your Bank Verification Number (BVN), proof of employment (salaried, self-employment, student), Monthly income of a minimum salary of ₦10000 then finally a good credit history. With this you can receive instant loan to accounts. For more information, visit Fairmoney

2. Palmcredit

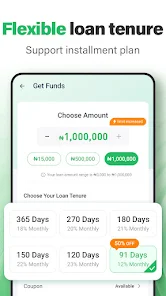

Palmcredit is one of the many popular loan app in Nigeria. They offer Nigerians instant loans of up to ₦300,000 with a repayment plan of 91 to 180 days. The interest rate is usually between 14% to 24% which is one of the best you can find in Nigeria.

The Palmcredit loan app is available for download in Playstore or you could check their social media handles for more details.

3. Carbon

Carbon is a digital banking platform that offers Nigerians access to instant loans and other bank services like investments, send and receive money, pay bills and lots more. Carbon is an all package app.

Simply download the Carbon app from playstore, register by submitting all the necessary details, like you BVN and other information which is required then a loan amount will be calculated and approved for you within minutes.

When you register on Carbon, you create a digital account with them and can fund your wallet for investments, paying of bills or sending and receiving money. To repay the loan, all you need to do is fund the wallet or account created for you and the loan will be deducted from the wallet.

The carbon app is available on Playstore or visit Carbon

4. Alat

Alat app gives you access to instant loans (3-5 mins) without any paperwork. To get an instant loan on Alat, you will need to provide few information and you are all set to enjoy the loan offers.

With Alat app you can borrow up to ₦2,000,000 with very little interest. Alat is a product of Wema bank and you can download the app on Google Play or vist Alat

5. Renmoney

Renmoney is a digital bank that gives access to instant loans and other bank services like investment, send and receive money, pay bills and savings.

Renmoney is one of the very popular digital banks among Nigerians and is fast growing, dominating the space.

With Renmoney you can borrow up to ₦3,000,000 with a repayment plan of 2 years or 1-2 months to, depending on the loan given. Many business owners have opted to use the Renmoney app. All that is required is your BVN, employment history, bank statement and other information.

Renmoney is available on Google play or visit, Renmoney

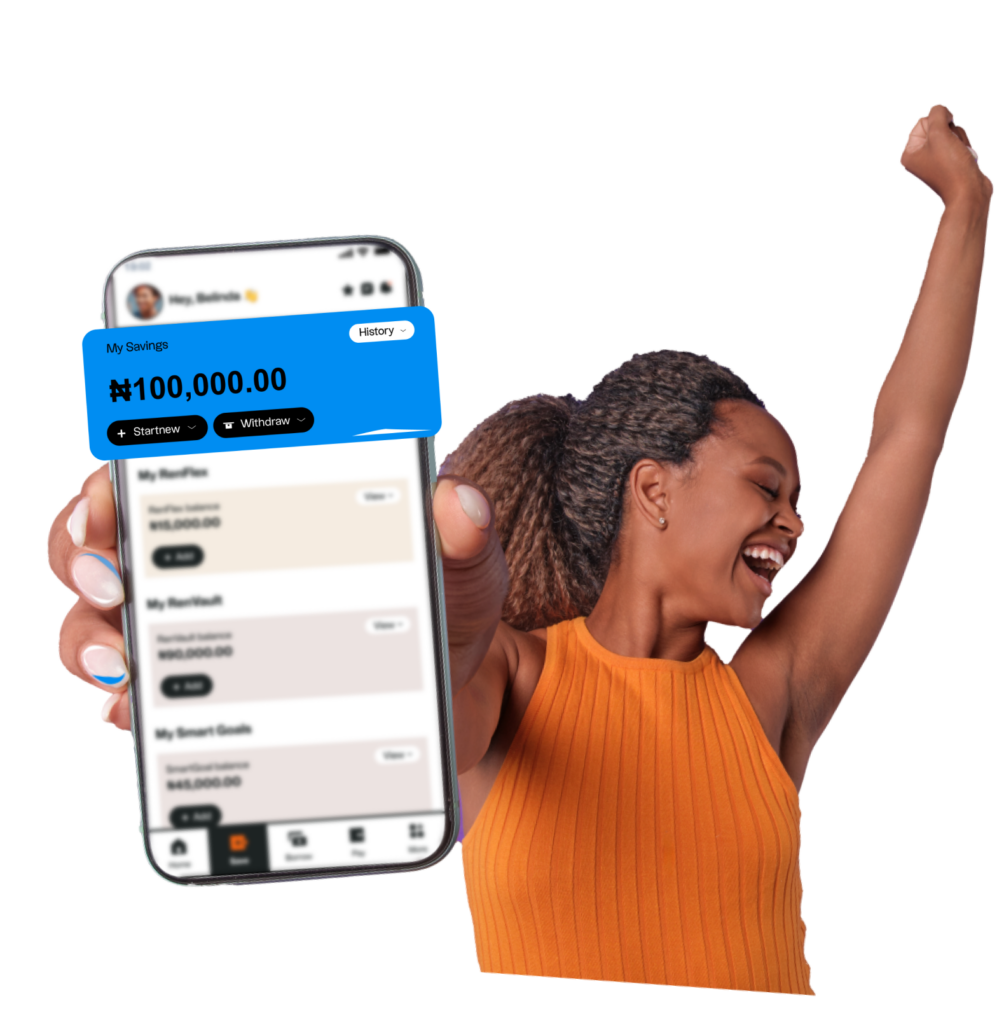

6. Aella app

Aella is one of the oldest and reliable loan app in Nigeria. Aella offers personal loans of up to ₦1,000,000 with very low interest rate of 6-20%, repayment plan of 1-3 months with no late/rollover fees. Aella makes the application process easy. Aella app is more than a loan app as it offers other bank services and insurance benefits.

Aella app is available on Google play or App store

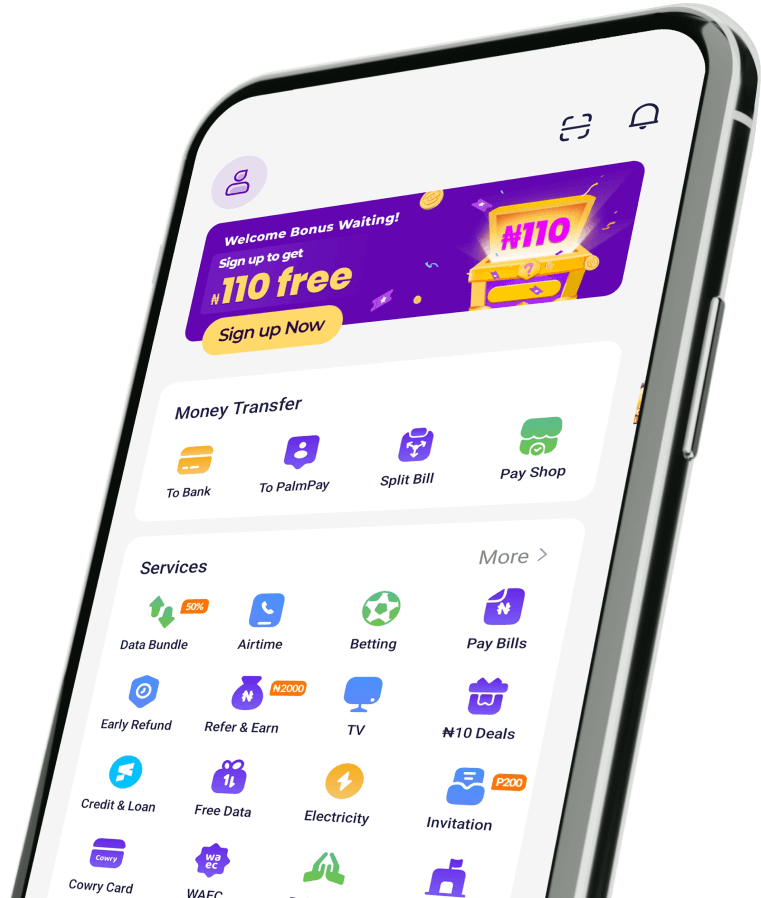

7. Palmpay

Palmpay is a digital bank that offers instant loans and other bank services like investments, savings, bills payment, send and receive money. Palmpay instant loans goes as high as ₦200,000 with no paperwork or collateral needed. The interest rates on palmpay ranges between 15-30% depending on your credit score and the amount you want to borrow.

Palmpay interest rates are quite with a short repayment period for first timers. However, over time, the repayment period will be extended as you use the loan service.

Palmpay is available on Google Play and App Store.

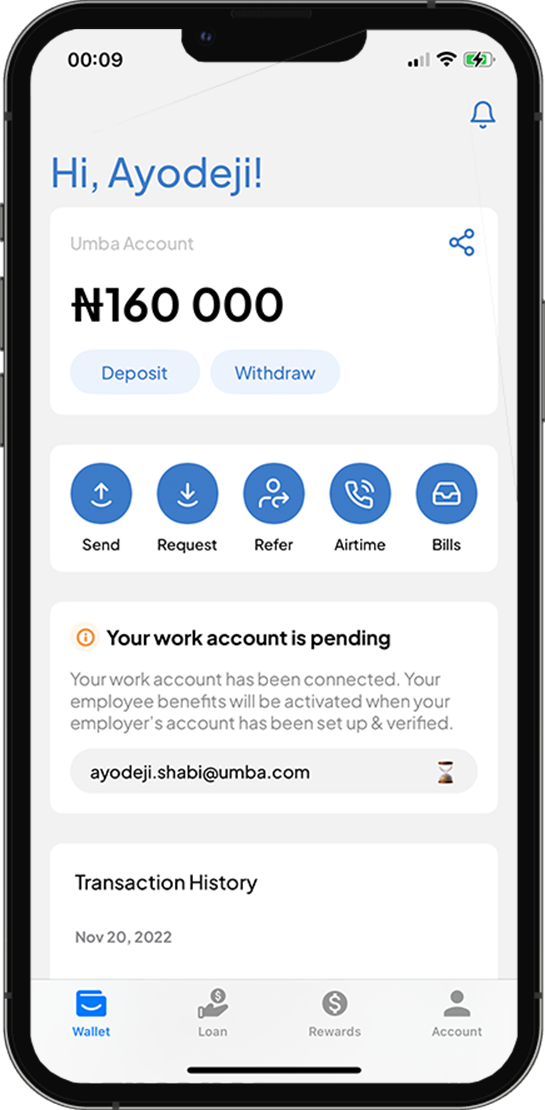

8. Umba

Umba is a digital bank that offers loans to users and other bank services like paying of bills, cash back, sending and receiving money. With Umba there are zero fee and unlimited transfers to users.

Umba loan offer ranges from ₦1,115 to ₦89,182 at 10% interest rate with a repayment tenure of 62 days.

9. Okash

Okash is one of the most popular loan app in Nigeria that gives users access to instant loans of up to ₦50,000 with no collateral. Your credit score determines the maximum loan amount you can receive.

The repayment tenure differs for each users but the more you use the services, the longer your repayment tenure.

Okash is available in google play or visit Okash

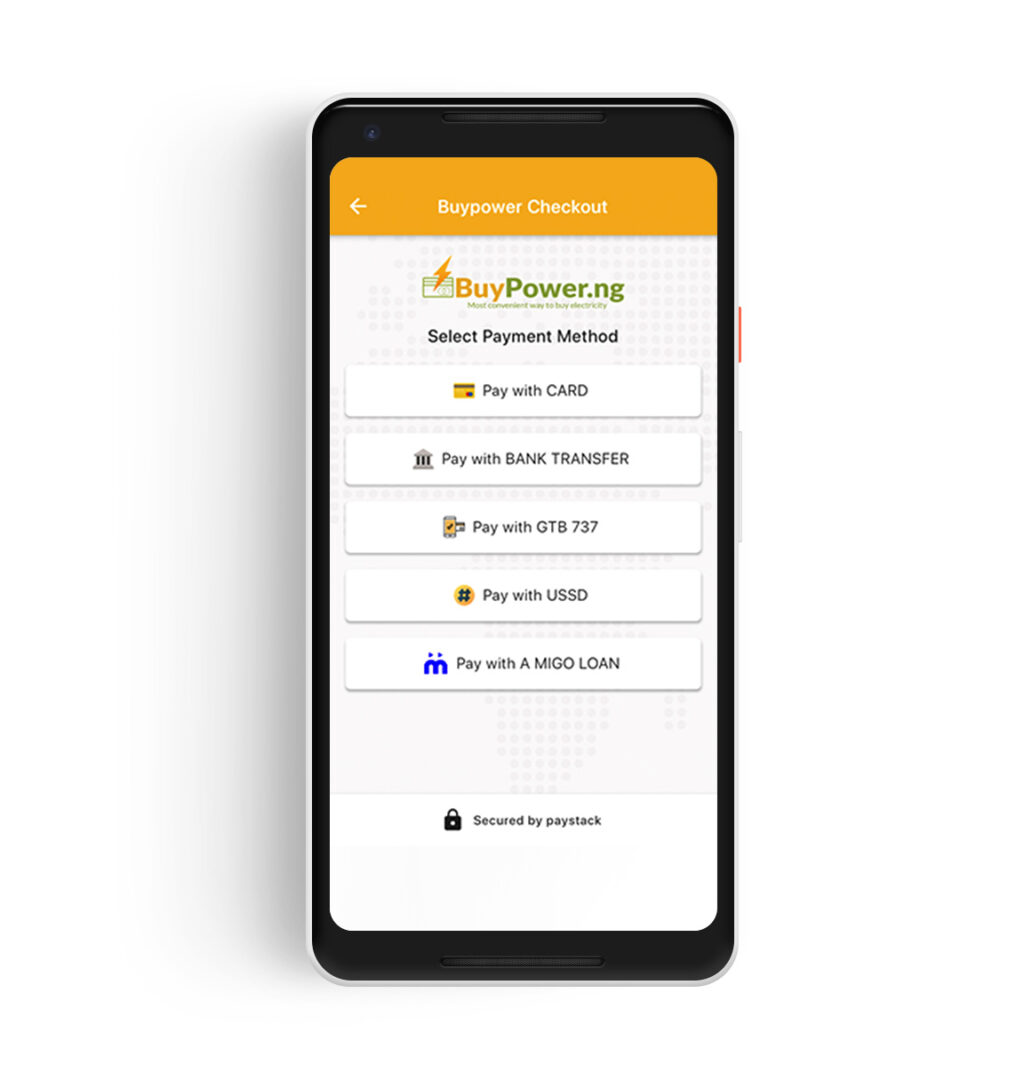

10. Migo

Migo formerly known as kwikmoney offers loan up to ₦500,000 within minutes with zero paperwork and collateral needed.

Migo is a fast growing loan company with over 40 billion naira borrowed to users. The transition from kwikmoney to Migo brought onboard more users and further building trust.

Migo interest rate ranges from 5-15% with a great repayment tenure depending on the loan requested and received.

11. Specta

Just like Alat, Specta is owned and managed by Sterling Bank, a commercial bank in Nigeria. Getting a loan from Specta does not require any collateral, guarantor or bank visit.

Irrespective of your occupation or bank, you can access a Specta loan amount of up to ₦5,000,000.

The Specta app can be downloaded on Playstore and has other interesting packages for you.

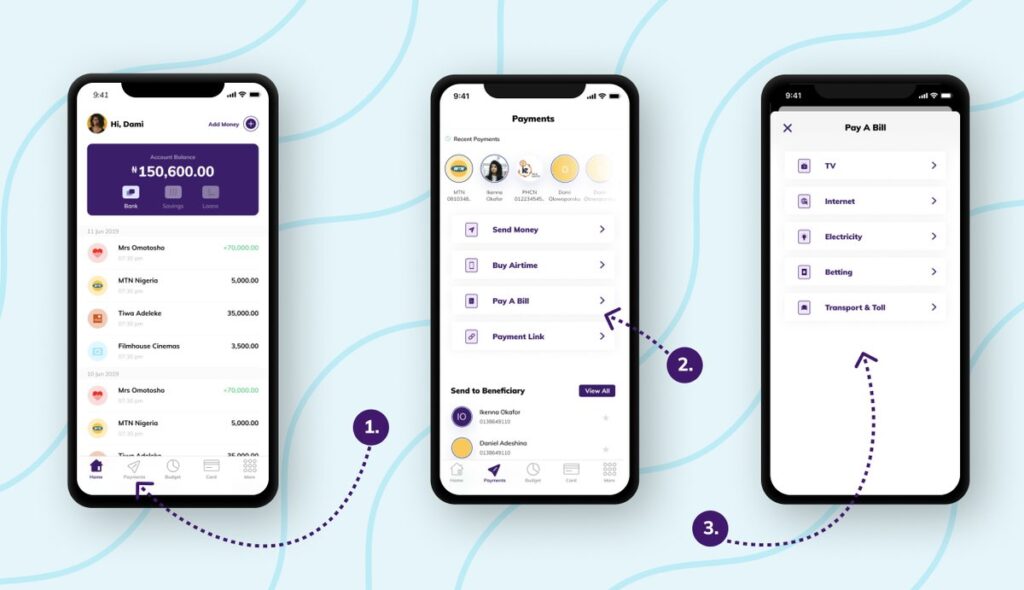

12. Kuda

Kuda is a digital bank in Nigeria that offers overdraft (loans) of up to ₦50,000 and other bank services like sending and receiving money, paying bills, savings and investments.

Kuda bank overdraft has a 0.3% daily interest rate and the loan amount you can get increases based on your usage of the app.

Kuda overdraft is one of the few low interest rates loans available in Nigeria.

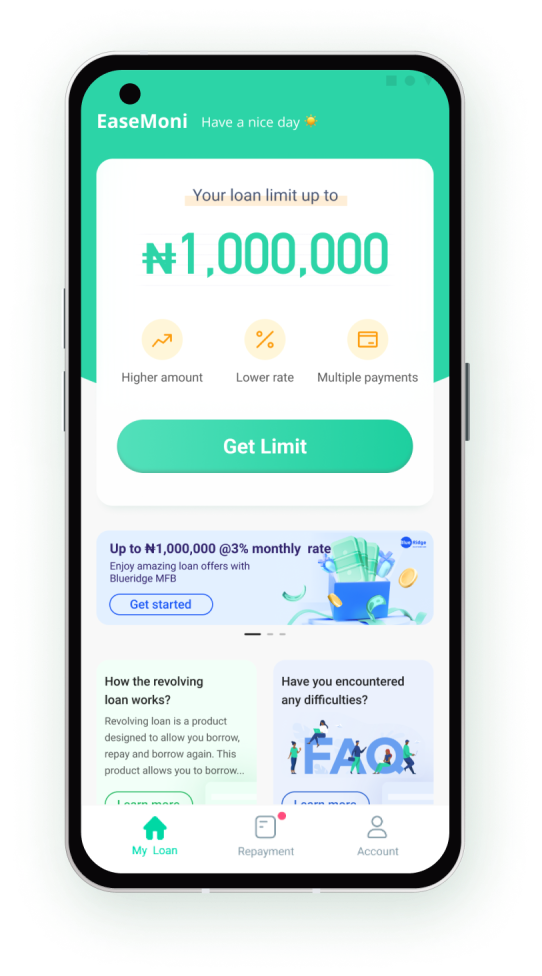

13. Easemoni

Easemoni is a fast growing loan platform among Nigerians. Easemoni offers users up to ₦500,000 with a repayment period of 1-2 months, depending on the repayment period selected. Acquiring a loan with Easemoni does not require any collateral or paper work. It takes 2- 5mins and the money is in your account.

14. JumiaPay

Jumiapay is a digital solution that offers instant loans to users alongside other bank services like paying bills (airtime, utility bills, etc) and shopping. Jumiapay loan does not require collateral or paper work, it takes just 2-5mins and you receive the loan amount in your account.

JumiaPay is available on playstore or visit JumiaPay

15. P2vest

P2vest is a fast growing loan app among Nigerians that offers instant loans for borrowers and better returns on capital for lenders (investors) who are in search of investment opportunities.

P2vest offers peer to peer lending that connects screened borrowers to lenders and investors. P2vest has a a B2B platform for businesses to manage these money lending activities, P2VFB. It makes it easy for business to take control and track all lending activities.

P2vest loan amounts are within the range of ₦5,000 to ₦2,000,000 with a repayment period of up to 12 months.

P2Vest is available on Playstore and App Store. You can visit, P2Vest

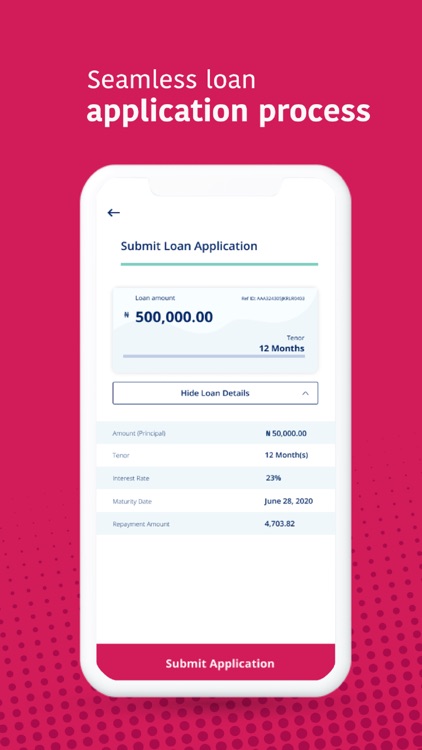

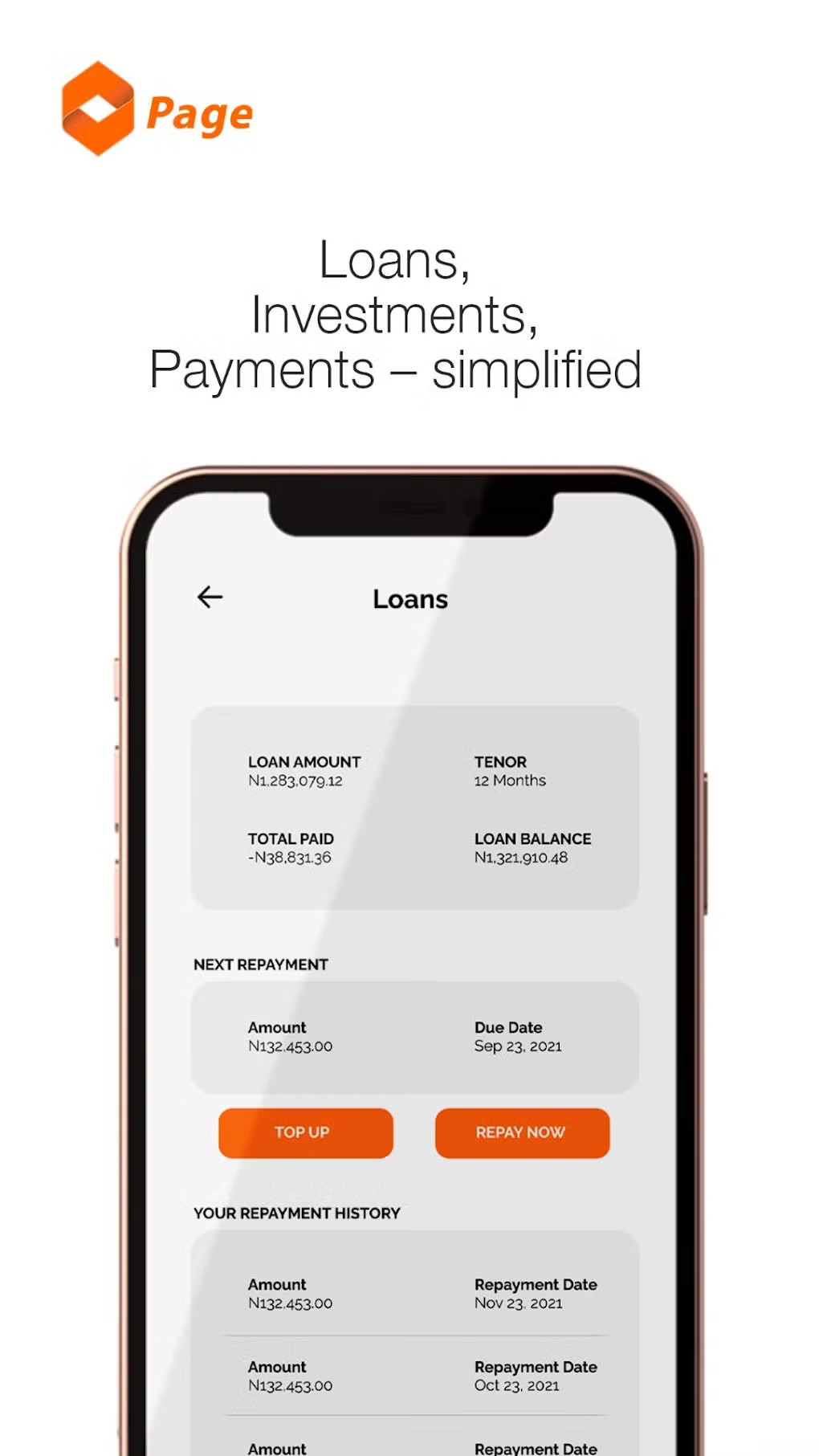

16. Page Financial

Page financials is a finance company that offers personal loans to Nigerians from ₦100,000 to ₦5,000,000 with a 3.76% interest rate charge every month with annual percentage rate of 29% – 120%. Page financials personal loan is easy to apply and comes with repayment period of 2 months (60 days) – 6 months (180 days). Page financials is licensed by CBN and the application process is not time consuming.

Page financial app is available on Playstore and App store or visit, Page Financial

17. Blocka Cash

Blocka Cash is a loan app in Nigeria that offers personal loans of up to ₦50,000 depending your credit score. Blocka cash loan has a competitive interest rate of 3-10% per month and an Annual Percentage Rate of 36% to 120%. To obtain a loan on Blocka Cash you will need a Government approved means of identification and must be above 21+.

Blocka Cash loan application process and approval takes 2-10mins and you can repay using various means like quickteller, direct transfer or an auto debit service enabled in the app.

Block Cash is available on Play store and App store or visit, Blocka Cash

18. Kredi

Kredi is a digital bank in Nigeria that offers loans to users and other bank services. Kredi offers different types of loans; Kredi Salary-baacked loan, Kredi Nano Loan, Kredi SME loan and Kredi collateral-backed loan.

Each of these loan types comes with a maximum amount you borrow. Although, the amount you can borrow is determined by your credit score or history. Kredi has a customer tier levels which also determines the amount you are qualified or eligible for.

Kredi is available on Play store and App store or visit, Kredi

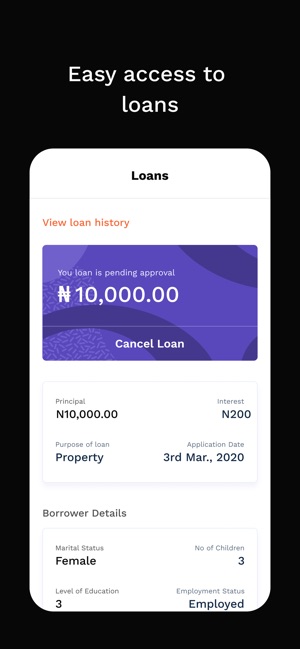

19. YesCredit

YesCredit is a loan giving platform that offers personal loans between ₦5,000 – ₦50,000 with an interest rate of 4.5% -35% with an equivalent monthly interest of 5%-29% with an Annual Percentage Rate (APR) of 29% – 120%.

Yescredit loan application and approval takes 2-5mins with no collateral, guarantor paperwork required. The repayment period is between 60 to 180 days and everytime you borrow and repay on time, you stand a chance of increasing your loan limits.

For faster application, you can reach out to Yescredit team or visit YesCredit

20. Quick Check

Quick check is a loan app in Nigeria that offers business loans of up to ₦1,000,000. Your loan limits increases as you borrow and repay on time with Quickcheck. For starters, you can access a ₦30,000 for 30 days depending on your credit history.

Quickcheck is available on Playstore and App store or visit, Quick Check